I’ve said for awhile that we could use some short-term selling to unwind overbought conditions and even negative divergences in some cases. I was looking for perhaps 4-5%, but it’s really difficult to predict the kind and depth of selling that we’ll see when secular bull markets face a downturn. Personally, I’d be shocked if this recent weakness morphs into a bear market. I’m not saying that it’s not possible, but my key signals suggest it’s very, very unlikely.

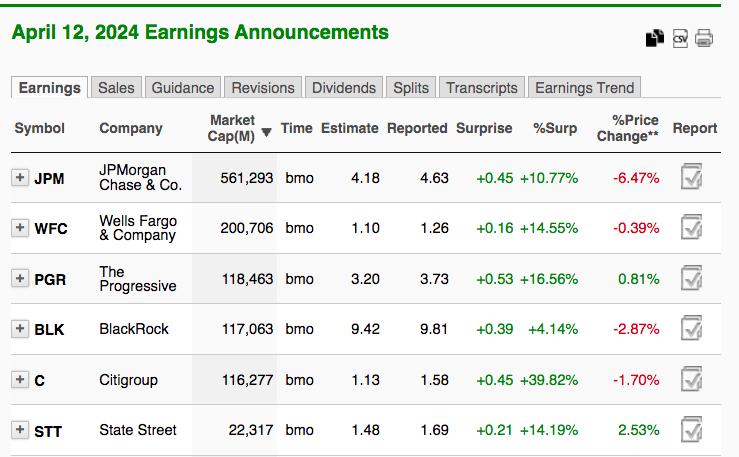

We’ve seen some downside moves in the past of just 1-2% and others, like the correction last summer, that stretched to 10%. I believe earnings will be strong, but the huge move off the October 2023 low may have built in that positive news. You’ve probably heard that old Wall Street adage, “buy on rumor, sell on news”, right? Well, that’s exactly what we saw Friday, with respect to the major financials that reported quarterly results Friday morning. The earnings numbers looked pretty good on Zacks:

Reported EPS was significantly higher than estimates in every case. Citigroup (C), in particular, crushed estimates, blowing them away by nearly 40%. There were revenue beats by all 6 companies as well:

Again, it was C that posted the best revenue beat – nearly 4% higher than expectations. From these tremendous numbers, it’s easy to NOW see why financials had performed so well.

But one thing that confuses many retail traders is that strong results do not always translate into higher stock prices. Check out the quarterly earnings price reactions on these 6 stocks:

Is this type of market reaction justified after seeing those quarterly results? I don’t think so, but the stock market doesn’t care what I think. Market makers have a job to do – build positions for their institutional clients at our expense. The short-term is NOT efficient. Prices don’t do what you think they’ll do. Then you get confused, believing financial stocks are dead. After they drop for awhile, you panic and sell and, after market makers get all the shares they need, financials regain their strength. This is what the stock market does. The short-term inefficiencies wear on traders, causing them to give up, and that creates supply for market makers to build their inventory. Then rinse and repeat. As the late great Yogi Berra would say, “it’s deja vu all over again!”

I discussed why we can’t trust this selling in my latest EB Weekly Market Recap VIDEO, “Hot CPI Stokes Inflation Fears”. The secular bull market remains perfectly intact. Check it out and leave me a comment. Also, please “LIKE” the video and “SUBSCRIBE” to our YouTube channel, if you haven’t already. It’ll help us build our YouTube community and I would certainly appreciate it.

On Monday, April 15th, I’ll be providing another financial stock that is poised to report excellent quarterly results. This company has been a huge leader among its peers, suggesting a blowout report ahead. If financials reverse their current weakness, I would not be surprised to see a very POSITIVE market reaction to this company’s report. To receive this company and check out its chart, simply CLICK HERE to subscribe to our FREE EB Digest newsletter. There is no credit card required to join the EB Digest, just your name and email address!

Happy trading!

Tom